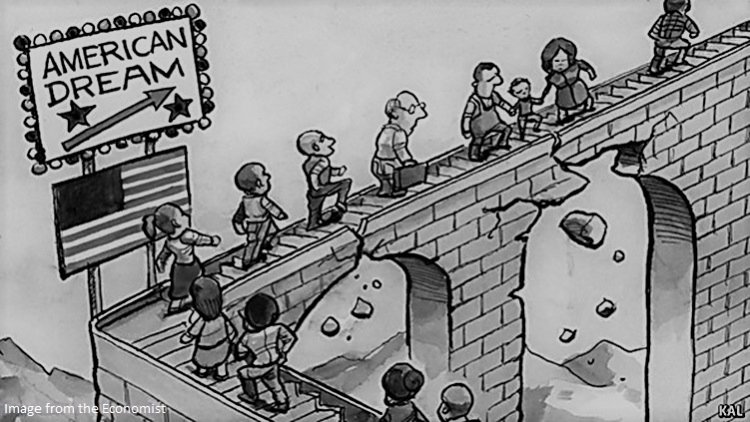

The Core of the Economy–The Middle Class–Is Crumbling

The net result of hyper-globalization and hyper-financialization is the crumbling of the middle class.

Neofeudal societies and economies lack a vibrant middle class. This is the defining feature of feudalism and its updated V2.0, neofeudalism: a nobility (based on birth or finance, it doesn’t matter) controls the vast majority of wealth, political power and productive capital, all served by a powerless peasantry.

The modern versions of capitalism emerged when a European middle class arose and became powerful enough economically and politically to dismantle feudalism. The fundamentals of the middle class are:

1. A mindset / set of values embracing (as highlighted by writer Peter Frost) “thrift, prudence, negotiation, and hard work.”

2. Access to markets and credit so enterprises could be established and expanded.

3. Sufficient education to navigate regulations and the requirements of enterprise.

4. The free flow of labor, capital, goods and services.

Feudal economies lacked these fundamentals by design. All these forces were restricted to enforce the power and perquisites of the Nobility.

Neofeudalism is a trickier beast. Neofeudal economies and societies make a big PR show of being open to new enterprise, but the real-world reality is not so warm and fuzzy: new cartels and monopolies arise in a fierce struggle to stamp out competition and influence regulators to not just enable predatory cartels/monopolies but defend them.

The past 30 years can be characterized by the ascent of capital and the decline of labor. As the chart below shows, wages’ share of the economy has been in a 45-year decline. The recent uptick may be a false breakout or it might be a change in trend. It’s too early to tell. But in any event, wages–the bedrock not just of the working class but of the middle class–have been chipped away to the tune of $50 trillion siphoned away by capital. (Source: Trends in Income From 1975 to 2018 RAND Corporation)

Another mechanism is visible in the charts below showing the Share of Total Net Worth of the top 1% and the middle class, i.e. the households between 50% and 90% (this broad definition includes the spectrum from lower middle class, households with incomes around the median, and upper-middle class households earning considerably more).

As the chart below shows, the top 10% own the vast majority of income-producing assets:, stocks bonds, income real estate and enterprises. The relative share owned by the middle class is at best modest, at worst negligible.

The key economic dynamic of the past 30 years is central bank-driven credit-asset bubbles which propel the assets owned by the top 10% to the moon. Those who own few such assets do not benefit from these asset bubbles, so their share of net worth (wealth) declines accordingly.

The two primary forces in the past 30 years are financialization and globalization, forces which accelerated under central bank / Neoliberal trade policies into hyper-financialization and hyper-globalization: hyper-financialization constantly inflates ever-larger asset bubbles, enriching the already-rich, while hyper-globalization forces labor to compete with lower-cost workforces globally, effectively transferring wages to capital, which can optimize labor / regulatory /credit / currency arbitrage to maximize corporate profits at the expense of the bottom 90% who depend on wages for their income rather than capital.

The most striking feature of the fortunes of the top 1% and the middle class is clearly visible: the share of total wealth of the top 1% soars to new heights in every bubble, while the share of the middle class dives.

The share of the middle class only rises when asset bubbles pop. This is the result of the top tier of US households owning the vast majority of assets: as bubbles pop, those who own few assets suffer far less than those who own most of the assets that bubble higher on the back of central bank stimulus and easy credit.

When the bubbles inevitably pop, the share of the top 1% crashes as the share of the middle class makes a temporary gain.

Please take a look. It’s rather remarkable, isn’t it?

The net result of hyper-globalization and hyper-financialization is the crumbling of the middle class, which has seen its share of the nation’s wealth and income eroded for the past 45 years, a trend that accelerated in the past 20 years.

Neofeudal economies and societies are static, brittle, dysfunctional and incapable of generating broad-based prosperity. Does that sound like an economy we know?

At readers’ request, I’ve prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the “Peanuts” comic character Lucy, who once issued this terse biographical summary: “A man was born, he lived, he died.” All undoubtedly true, but somewhat lacking in narrative.

I was raised in southern California as a rootless cosmopolitan: born in Santa Monica, and then towed by an upwardly mobile family to Van Nuys, Tarzana, Los Feliz and San Marino, where the penultimate conclusion of upward mobility, divorce and a shattered family, sent us to Big Bear Lake in the San Bernadino mountains.

The next iteration of family took us to the island of Lanai in Hawaii, where I was honored to join the outstanding basketball team (as benchwarmer), and where we rode the only Matchless 350 cc motorcycle on the island, and most likely in the state, through the red-dirt pineapple fields to the splendidly isolated rocky coastline. In 1969-70, this was the old planation Hawaii, where we picked pine in summer beneath a sweltering sun.

We next moved to Honolulu, where I graduated from Punahou School and earned a degree in Comparative Philosophy (i.e. East and West) at the University of Hawaii-Manoa. The family moved back to California and I stayed on, working my way through college apprenticing in the building/remodeling trades.

I was quite active in the American Friends Service Committee (Quakers) and the People’s Party of Hawaii in this era (1970s).

I next moved to the Big Island of Hawaii, where my partner and I built over fifty custom homes and a 43-unit subdivision, as well as several commercial projects.

Nearly going broke was all well and good, but I was driven to pursue my dream-career as a writer, so we moved to the San Francisco Bay Area in 1987 where I worked in non-profit education while writing free-lance journalism articles on housing, design and urban planning.

Within a few years I returned to self-employment, a genteel poverty interrupted by an 18-month gig re-organizing the back office of a quantitative stock market analyst. I learned how to lose money in the market with efficiency and aplomb, lessons I continue to practice when the temptation to battle the Monster Id strikes.

Somewhere in here my first novel was published by The Permanent Press, but alas it fell still-born from the press–a now monotonous result of writing fiction. (Seven novels and I still can’t stop myself.)

I started the Of Two Minds blog in May 2005 as a side project of self-expression, and in an unpredictable twist of evolutionary incaution, that project has ballooned into a website with about 3,500 pages that has drawn almost 20 million page views.

The site’s primary asset may well be the extensive global network of friends and correspondents I draw upon for intelligence and analysis.

The blog is #7 in CNBC’s top alternative financial sites, and is republished on numerous popular sites such as Zero Hedge, Financial Sense, and David Stockman’s Contra Corner. I am frequently interviewed by alternative media personalities such as Max Keiser, and am a contributing writer on peakprosperity.com.

End conventional bio; bits and pieces

My work does not fit into any ideological box; indeed, I view all ideologies as obsolete and misleading. I doubt this is a surprise to you if you’ve read the blog.

My lifelong avocations include bicycling, gardening, guitar, camping in the American West, cooking, carpentry and fitness, all of which are reflected in the blog.

I would re-write the bumper sticker “New York, London, Paris, Hilo” as “Shanghai, Kyoto, Bangkok, Paris, Hilo.” Many people wonder where I live; I split my time between the S.F. Bay Area and the Big Island, though I visit friends and family on Oahu as often as possible.

Our heritage is Scots-Irish (County Down), English and French; via marriage the family inlcudes Hispanic-American, African-American and Asian-American members. I think the word is polyglot.

Our military history: grandfather, U.S. Navy, 4-stack destroyer U.S.S. Lea (DD-118), Pacific/China, 1920-22; father, U.S. Navy, LST, Pacific Theater, 1945; uncle, Army Air Force, 1943-44, 25 B-17 missions over Europe; stepfather: Career U.S. Air Force, retired as Lt. Colonel, served in U.S., Europe, Vietnam and Korea.

Measured in terms of money I am not rich, but measured in friendships, health and output, I feel very wealthy indeed. I like my work and feel there is purpose in the blog’s independent critiques of the Status Quo and in the positive view I have of the next iteration of our economy and society.

I lead most of my life in the real world, and as a result my time online is extremely limited. This is why email to this site is read but may not be acknowledged. I regret the limitations but I receive thousands of emails a year and am only one 60-year old person with many other duties and tasks.

In my experience, good luck is rare; the default setting is rejection, disinterest and failure. I concur with Winston Churchill, who held that “Success consists of going from failure to failure without loss of enthusiasm.” That more or less sums up my biography.

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free