What Happens When There’s Nobody Left

To Save Us?

Passively waiting for centralized powers to “save us” from their own excesses is not a solution.

It’s no exaggeration to say that our way of life depends on somebody somewhere saving us from the excesses that are the bedrock of our way of life. What excesses, you ask? There are none. This is true in one sense: all the excesses have been normalized by previous “saves”: whenever the bedrock excesses threaten to collapse under their own weight, the Federal Reserve or the Federal government rush in to save us from the excesses they’ve created.

Stripped of artifice, the bedrock excess that has been completely normalized is to goose consumption by borrowing from future earnings and resources. As long as growth is eternal, this works great: we can always pay more interest on ever-expanding debt with future earnings because those will be inevitably be even larger than the interest due.

Creating money out of thin air is another mechanism that achieves the same goal: goosing consumption via boosting the value of assets to generate a “wealth effect” that lifts all boats. This is also predicated on the eternal expansion of earnings, so wage earners can afford to consume as new money ceaselessly devalues the purchasing power of existing money (what we call inflation).

The problem is these “saves” only work if the interest rate is eternally near-zero and the costs of production are eternally declining: as long as it costs almost nothing to borrow more money into existence and production costs continue to drop, enabling consumers to afford more goodies even as the purchasing power of their wages declines, then all is well.

But capital eventually demands yields above zero as risk rises and risk rises along with debt and production costs, both of which depreciate the value of future earnings: as debt service costs rise, more earnings must be devoted to paying interest, reducing the sums available to spend on consumption. As production costs rise, the earnings left to spend buy less.

In other words, the “saves” increase risk, and eventually yields rise in response. The debt dragon begins eating its own tail. Risk cannot be dissipated into the ether, it can only be hedged or offloaded onto some other entity. There are no hedges against systemic debt saturation, and the risks are being offloaded onto the entire system. When risk can no longer be suppressed with more “free money,” the entire system collapses under its own weight.

The consequence of these dynamics is there won’t be anyone left to “save us” with free money next time around. As capital demands a return above zero and the devaluation of existing money pushes production costs higher, the system can no longer sustain its excesses.

So what happens when there’s nobody left to save us? The mind rejects this possibility. Surely the Fed or the federal government will find some way to flood the economy with whatever sums of “free money” are needed to keep borrowing from the future. But the excesses of money creation and debt are self-defeating: they become the Monster Id dissolving the system rather than the “save us” solution.

All ideologies have a fatal flaw: they limit potential solutions to a single limited tool box. All ideologies are simple formulas at heart, and they all define the “problem” in a way that their proposed solution can remedy.

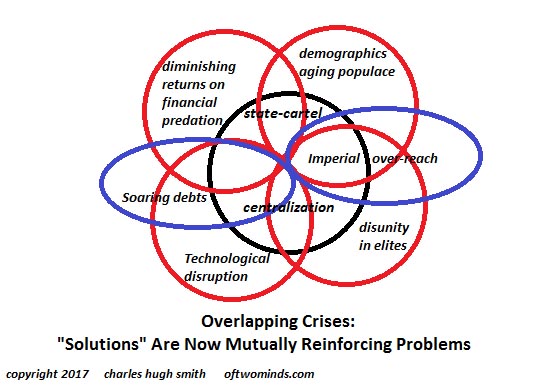

But the problems we’ve generated are interconnected in ways that can’t be remedied with only one fix. The global socio-economic system we’ve created is an open system that isn’t entirely predictable–it is an ecosystem, not a clock. It generates feedback loops that funnel risk back into the system itself with every “save.”

We need to be able to select solutions from a wide assortment of tools, yet the mechanisms that have “saved us” in the past–central banks and governments–are wired to see the expansion of their own power as the only effective solution to any problem. This innate drive to expand their reach and power is the ontological imperative of centralized hierarchies, dynamics I untangle in my book Resistance, Revolution, Liberation.

This expansion of centralized power inevitably limits our choices of solutions and freedom to choose for ourselves. Call this whatever you wish, but this limiting of choice is a limiting of solutions, and the limiting of solutions is fatal to all open systems, regardless of size or apparent power.

The “saves” have loaded the entire system with excesses that cannot be resolved with even greater excesses. Risk is rising, and the “saves” have only increased systemic risk. Those doing the “saving”–central banks and governments–are squeezing out whatever choices and solutions are not within their control, increasing our dependence on their “saves” of ever greater waves of “free money.”

So what happens when there’s nobody left to save us? We have to save ourselves, that’s what. It’s called Self-Reliance, which means preserving our freedom to choose options and solutions that work for us and our communities. Gordon Long and I discuss this in our recent video podcast Self Reliance & The Importance of Choice (24 min), the second segment in a three-part exploration of self-reliance.

Passively waiting for centralized powers to “save us” from their own excesses is not a solution–it is magical thinking at its most dangerously delusional. Better to grab a tool box and start filling it with tools that you own and control.

https://cultivateelevate.com/antioxidant-trio-6mix-dragons-blood-pearl-powder/?ref=2bfG3v4vqhqnIp

https://cultivateelevate.com/antioxidant-trio-6mix-dragons-blood-pearl-powder/?ref=2bfG3v4vqhqnIp