Your Money Is Their Money (Part 1)

The financial arm of the plandemic octopus and the coming engineered collapse.

The Plandemic Octopus has eight arms (See the bottom of this link for the other seven):

Today’s Octopus Arm—The Financial Coup:

- Eliminate unfunded pension liabilities by eliminating pensioners (Still in progress. “Goodbye Grandpa. We loved you so much.”)

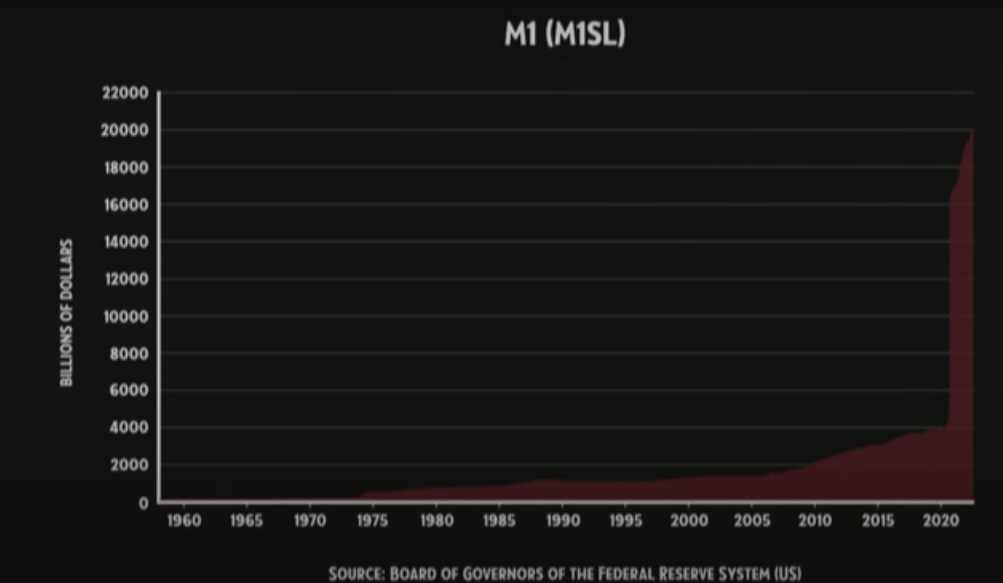

- Intentionally create inflation by printing trillions of dollars in 2020 to fight a fake virus during a hoax pandemic.

- Increase interest rates (pretend to fight inflation) at the fastest rate in history while chopping the legs off liquidity by rapidly decreasing the M2 money supply (2022)

- Use an excuse of distressed bond assets to cause big depositors to panic, triggering a run on banks, then bail them out, guaranteeing all uninsured deposits ($18 Trillion).

- Bail out ALL bank depositors, and permit larger banks to absorb smaller banks, creating the ultimate moral hazard while setting the stage for bail-ins next (We are here)

- Target all the crypto lenders and banks first to eliminate CBDC competition, while pinning blame on any engineered crises on “unregulated cryptos” before banning cryptos outright

- Bail-ins and hyperinflation will leave tens of millions without money to set the stage for compensation with programmable CBDCs, with alternatives such as Bitcoin outlawed

- A quadrillion-dollar derivatives bomb will go off causing further panic

- As the suffering (demolished SS, pension funds, 401ks, and USD) reaches an apex dump the mother of all slave chains with the CBDC nuke, tied to a social credit system with UBI (Universal Basic Income)

The official narrative on the Silicon Valley Bank (SVB) collapse is that the bank was holding too many worthless bonds on their books that accounting regulations required them to hold. These bonds lost their value as the Fed raised interest rates over the past year at the fastest rate in history—from 0%-5% in under a year.

None of that has anything to do with the disintegration of SVB. Make no mistake this was a planned run on the bank, much of it triggered by CIA partner and Palantir Founder Peter Thiel, who performs part-time at conferences as your friendly neighborhood libertarian.

Thiel warned VCs and start-ups to get their money out of SVB. $42 Billion was siphoned out in 48 hours and the bank was left with a negative one billion dollar problem. Except, one billion dollars is nothing for the banking sector or the government. In October 2008 that amount was lost by major banks every hour in the MBS and CDS derivatives Ponzi scheme when their true ratings were exposed.

Spectacularly Vacuous Bank’s stock value dropped 80% in a blink and to zero in another blink.

And all of their uninsured depositors should have been vaporized.

Billionaire crybabies like market manipulator and financial criminal Bill Ackman and sportsball doofus Mark Cuban whined that all depositors over $250,000 (above FDIC insured) needed a bailout. Apparently, this included Oprah Simpfrey and her oppressed neighbors Prince and Princess Sniffles. Within 48 hours they had their bailout for not just SVB, but all small and regional banks with distressed bonds that didn’t hedge accordingly.

SVB supplied massive amounts of capital to a number of Chinese tech venture capitalists and China’s startup entrepreneurs. Biden was paid handsomely by China to work for China once in office. Their “10% for the big guy” investment is paying off.

Two Israeli banks with deposits in SVB got paid off quite early in the game as you’d expect of card-carrying frequent finance members.

Times of Israel, March 12: Israel’s two largest banks, Bank Leumi and Bank Hapoalim, set up a situation room that has been operating around the clock to help firms transfer their money from SVB — before it was seized — to accounts in Israel. Over the past few days, teams at LeumiTech, the high-tech banking arm of Bank Leumi, have been able to help their Israeli clients transfer about $1 billion to Israel, the bank said.

Curiously this also happened just as JPMorgan Chase and CEO Jamie Dimon were in hot water as a judge ordered him to produce documents related to Jefferey Epstein being a preferred client of Dimon and Chase, and who before not killing himself in prison, also had ties to Mossad and those Israeli banks.

Epstein was the guy who entrapped the rich and powerful into compromising positions with trafficked kiddies and filmed their paedo activities in secret and then held those tapes as bribery collateral against oligarchs, former Presidents who starred in Real Stories of The Arkansas Highway Patrol, and depopulation vaccine enthusiast software developers in cardigans.

Dimon and Chase were Epstein’s official financial courtesans. Did JPMorgan Chase pull the largest deposit from SVB to trigger this run since they stand to gain the most as the largest bank in the U.S. by assets?

Look! An SVB Squirell!

Ghillane Maxwell, Epstein’s Madam Kidnappeuse is still the first person in legal history convicted of sex trafficking minors to…nobody.

The SVB contagion spread to other regional and small banks with underwater bonds on their books, again to the benefit of the big five “too big to fail” banks.

Thanks to a $2 trillion dollar bailout announced last weekend via something called BTFP—Bendover The F**king Plebs—banks could trade in their underwater bonds at par, and make their accounting books look whole again.

Instead of hedging against rising interest rates, irresponsible banks like SVB gave $75 million to neo-Marxist terrorist groups like Burn Loot Murder (BLM) and spent millions more making parody commercials and hiring all the worst candidates for every job because they checked boxes on the DIE matrix.

What’s a bond? Anyway, I grew up in Guatemala, and my mother is a non-binary Jamaican voodoo doctor…

You’re hired soul sista! Welcome to Silicon Valley Bank. Your Chief Risk Analyst business cards will be on your desk this afternoon.

For months the survivalist channels on YouTube and Bitchute have been warning of bank runs. At a November FDIC (Federal Deposit Insurance Corporation) meeting, board members telegraphed the events that we will witness when they permit bail-ins.

Flip a coin.

Heads—Bailouts: Taxpayers (Fed) bails out depositors or institutions

Tails—Bailins: Banks steal your money

You lose.

Thanks for playing.

What is money?

Cotton paper with fancy ink and holograms. An official printing operation with the backing of standing armies and energy reserves. A system based on fairy dust and the trust of gullible greater fools.

What is fractional reserve banking?

A system of banking that allows banks to only hold a fraction of depositor money. Meaning your money is their money to lend and speculate with at will, and when you go to collect it you are not collecting your money, but just money.

What are bank runs?

If people ever wake up to this scam and lose trust in the system, and they panic when they realize banks can’t pay out everybody who suddenly wants to retrieve their money all at once, withdrawals are limited or halted completely. Bank doors shutter and further panic ensues at other banks. These panic runs were rigged by larger banks in the 1890s and early 20th century to destroy competitors and as justification for the Federal Reserve Act of 1913.

What are bank accounts?

Computer software. Ones and zeros where your cash is NOT held and can be seized any time there’s a “crisis” whether real or fabricated.

What is the entire financial system of central banks, IMF, and BIS?

A Ponzi scheme for the rich to loot and destroy currencies on the backs of tax-paying working debt slaves, and to enslave and colonize third-world countries with endless amounts of unsustainable IMF obligations in exchange for the right of corporations to rape and pillage their resources.

Trust their “banking” system at your own risk.

To be clear the Federal Reserve schizo policy is now:

- Raising interest rates to pretend to fight inflation for the “little guy” since inflation doesn’t affect the people the Fed really works for, even though they haven’t come close to fighting inflation and will need to raise above 10% to even begin the fight

- While decreasing the M2 money supply at the fastest rate in history, sending it negative for the first time since the Great Depression

- And now bailing out underwater bonds of irresponsible banks while diddling the rich and uber-wealthy by guaranteeing all uninsured deposits, with what will ultimately be more inflation-creating money printing

Just when it seems the financial moral hazard created by the Federal Reserve cannot get any more treacherous, the fu**ers find a way. There is no way they can mathematically fight inflation while at the same time saving irresponsible banks by compensating their bond losses while guaranteeing all uninsured deposits.

Imagine a house on fire. Firefighters in the front hose it down with water. Then they run around to the back of the house and hose it down with gasoline. Then they run back to the front of the house, and they repeat this until there is only an ash heap. This is what the Fed has just announced they will be doing.

What the average economically illiterate American sees is a perfect white colonial home that’s not even on fire.

But that ash heap is only months away from revealing itself to everyone, and it’s all by design.

Inflation figures are manipulated downward. Real inflation peaked near 20% last summer while the gimmick-accounting “official” peak was 7.8%. The government can lie about everything because the people are no longer capable of doing rudimentary mathematics, or thinking critically.

But inflation is on the rise again in recent months. And the reaction of the American people to this latest $2 trillion bailout of small and medium-sized banks and guarantee of another $18 trillion in uninsured deposits should more banks fail?

The looting will continue until the equations are solved.

Everything revolves around money printing and cheap credit for heroin addicts who speculate with taxpayer money. They wanted a Fed Pivot (from raising rates to lowering them again) and just like in the 19th century, the smaller banks will continue to get run down until the Fed gives the addicts what they want. But they’ve claimed for 14 months straight to be dedicated to fighting inflation. The second they ‘Pivot’ they signal they’ve completely given up on inflation and the American people will just have to lose more of their money each month.

The Dow will rocket to 90,000 like in Venezuela.

A Ford Tough truck will cost $170,000.

And a loaf of bread will set you back $80.

The Fed also knows the average American has no idea what inflation or even fractional reserve banking is. They think when they deposit money at a bank, it will be there safely waiting for them anytime they need it and it will be of the same “value” and not less when they retrieve it.

They do not know the banks use their money to speculate with investments and take risks to make even more money while nickel and diming them on overdraft fees and ATM withdrawals, money transfers, and direct deposits all for the “privilege” of not even holding their money.

And now, after last weekend they do not realize that when the entire banking system is absorbed by the big five “too big to fail” banks, which it will by design, there will be bail-ins as authorized by Dodd-Frank and just as the clowns at the FDIC board announced in that video above.

The big banks will steal your money, while the Fed will compensate the rich depositors—uber-wealthy individuals, and corporations first, and then claim they can’t make millions of citizens whole.

Your money has always been their money.

Whenever there is money needed for wars or bankers, it magically arrives.

Whenever there is a “crisis,” real or manufactured, magic money will be printed on the backs of taxpayers.

Whenever bankers want to take stupid risks, they know they’re doing it with house (taxpayer) money and so they can never lose.

Which begs the question: Why pay taxes if any amount of money ever needed can simply be printed without consequences?

In March of 2020, the Fed started juicing the markets with $9 trillion, buying up every distressed and non-distressed asset, ETFs, Apple Stock, Bonds, and probably the kid’s lemonade stand on your street. Blackrock was their official discount window servicing pimp.

At the same time, Congress added another $5 Trillion with the CARES ACT, $3 Trillion to keep the plandemic handouts going in 2021, and another $1.2 Trillion for “Infrastructure,” which was another diversity and equity carnival about a racist highway system and to prepare the derailing of toxic trains around the wrong kind of voters.

Between January 2020 and October 2021, the US printed nearly 80% of all US dollars in existence. From $4.0192 trillion in circulation to $20.0831 trillion dollars in circulation.

All this massive inflation-inducing money-printing because of an “invisible virus” that was waiting to kill everyone at any moment.

The peak just happened to coincide with a peak in the speculative stock market frenzy proving that markets are only a reflection of low-interest rates and money supply.

Three months after that speculative frenzy and two years of UBI trials—direct deposits to all Americans—people began wondering why their grocery bills had doubled.

A century ago, Weimar Germany conducted the same reckless monetary policies. Punitive war reparations, an import blockade by the British, and a nation in shambles led to the abandonment of Goldmarks and the mass printing of paper marks. This is the inevitable path the Federal Reserve has just chosen for the American people. And it’s all by design to destroy the old analog system to usher in digital financial slavery.

Central banks are in opposition to free markets. They are entities for enslavement through credit (usury) at all levels. They create fictional money (fiat) tied to nothing by the source of the power/tyranny of the state’s standing armies, or energy monopolies. They intentionally inflate the currency to manage their own liabilities.

There are no free markets. There are centrally controlled markets for both exploitation and looting, and intentional demolition to usher in their new system for enslavement—Central Bank Digital Currencies (CBDCs).

Fedcoin—the Federal Reserve’s CBDC went live for trials late last year. Biden signed an executive order last March to unleash this financial hell on Americans as part of the Great Financial Reset. FedNow, an instant settlements program for transfers (Not a CBDC) is also on the way. Phase one of the rollout of FedNow will be this summer.

Once all institutions are onboarded into the FedNow system, the dollar collapse will accelerate both as a global reserve currency, and a source of legal tender by rendering it worthless through hyperinflation. When desperation and panic are at an apex, they will unleash the ultimate set of financial chains on the American people.

FedCoin —- through —-FedNow.

The only game in town.

In Part 2 (Monday) we dance with the CBDC devil and go step-by-step through what has to happen this year for the Fed to roll out a successful CBDC in the future that can’t be rejected by the people.

Plus the most prudent steps Good Citizens can take in the near term to protect against this theft and tyranny so that there will be no alarms and no surprises.

Join The Good Citizen Central Bank Dignity Confiscation Club

good job but i dont understand the part about decreasing M2. i think that it would be a good policy to decrease M2 but i didnt understand from the article what the Fed is going to do to achieve that. in my opinion the crypto exchanges did not suffer due to any malicious forces that targeted them. crypto exchanges should not exist. period. the only benefit that you can ascribe to them is the fact that because of all the pumping, and subsequent dumping, the mass media and popular opinion turned its attention to crypto currencies without which maybe the entire system would have disappeared due to lack of use. even though it is a public benefit.

unfortunately, the crypto exchanges only facilitated a new pump & dump scheme, based on penny stock schemes. they also facilitated naked short selling, which is something that nobody who buys crypto currencies would have anticipated, and that was by design, part of the fraud that they perpetrated upon the public, the retail buyers.

Crypto exchanges are in the open for their bad faith towards their users. They opened their doors to predators who have no interest in blockchain technology, nor anything else, besides robbing the balances of the account holders. A good case can be made for promoting the fact that they deserved to be defrauded. we have been hounded since the early days of blockchain with this advice: NOT YOUR KEYS, NOT YOUR COINS. did you heed that advice? that is a YES or NO question.